Invest In Tax Saving Mutual Funds Online

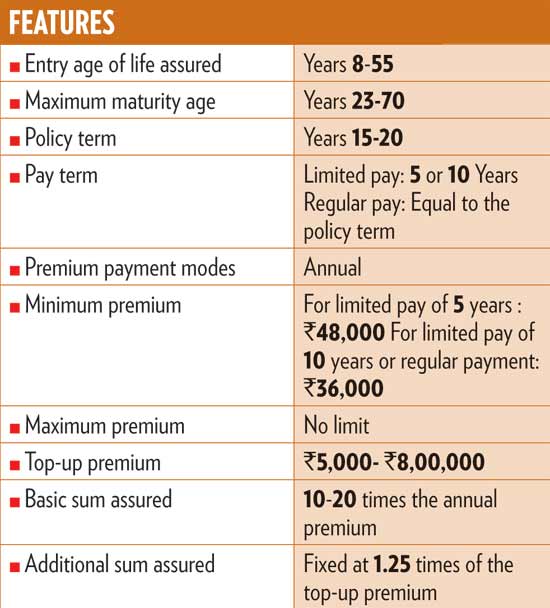

ING Market Shield from ING Vysya Life Insurance is a unit-linked insurance plan (Ulip) that offers you the highest net asset value (NAV) guarantee on a daily basis over the term of the policy. Unlike other NAV-guaranteed products, however, the policy guarantees only 80 per cent of the highest NAV achieved with a maximum of 60 per cent exposure to equity—making it function more like a balanced fund.

The fund has the mandate of investing 0-60 per cent in equities and 40-100 per cent in money market instruments and cash. In rising market conditions, the fund exposure to equities increases and in declining market conditions, the fund increases its debt exposure until markets improve. If the equity exposure of the fund falls to zero, in that period no guarantee cost is charged.

Death Benefits. This is a Type I policy, which pays the greater of the sum assured or the fund value. Moreover, to protect the downside, the insurance regulator has, recently, made mandatory that death benefit should not be less than 105 per cent of the premium paid in all cases.

Partial withdrawals and loans. You are allowed to make partial withdrawals after five years for a minimum amount of Rs 5,000 and a maximum amount equal to 25 per cent of the balance in the fund, provided after each withdrawal the balance in fund is not less than 1.5 times the annual regular premium.

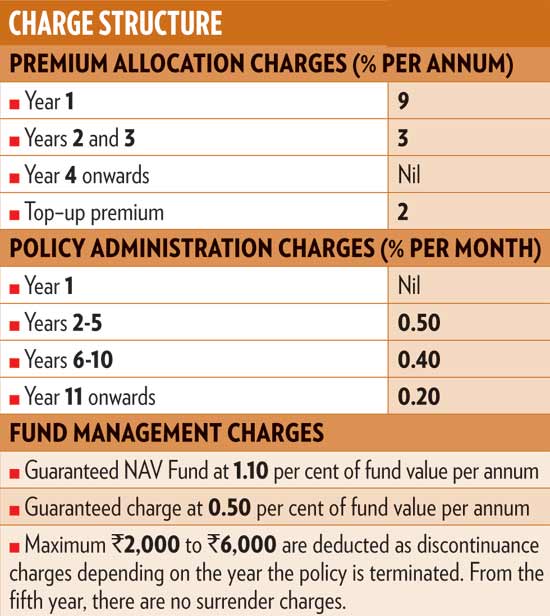

Cost. For a 35-year-old male, paying annual premiums of Rs 50,000 for 15 years for a sum assured of Rs 10 lakh (20 times the premium), the policy will pay Rs 9,69,389 and Rs 13,59,311 at an assumed growth rate of 6 per cent and 10 per cent, respectively. The net yield comes to 3.14 per cent and 7.13 per cent (after deducting mortality), respectively.

Conclusion. ING Market Shield has a mandate to invest from 0-60 per cent in equities. Given the fact that most of your investments could be in debt and there is restricted equity exposure, do not expect very high return from the product. It is good for those policyholders who want some exposure to stock market without risking their initial capital.

Happy Investing!!

We can help. Call 0 94 8300 8300 (India)

Leave your comment with mail ID and we will answer them

OR

You can write back to us at PrajnaCapital [at] Gmail [dot] Com

---------------------------------------------

Invest in Tax Saving Mutual Funds ( ELSS Mutual Funds ) to upto Rs 1 lakh and Save tax under Section 80C.

Invest Tax Saving Mutual Funds Online

Tax Saving Mutual Funds Online

These links can be used to Purchase Mutual Funds Online that are regular also (Investment, non-tax saving)

Download Tax Saving Mutual Fund Application Forms from all AMCs

Download Tax Saving Mutual Fund Applications

These Application Forms can be used for buying regular mutual funds also

Some of the best Tax Saving Mutual Funds available ( ELSS Mutual Funds )

- ICICI Prudential Tax Plan Invest Online

- HDFC TaxSaver Invest Online

- DSP BlackRock Tax Saver Fund Invest Online

- Reliance Tax Saver (ELSS) Fund Invest Online

- Birla Sun Life Tax Relief '96 Invest Online

- IDFC Tax Advantage (ELSS) Fund Invest Online

- SBI Magnum Tax Gain Scheme 1993 Invest Online

- Sundaram Tax Saver Invest Online

- Edelweiss ELSS Invest Online

Best Performing Mutual Funds

- Largecap Funds Invest Online

- DSP BlackRock Top 100 Fund

- ICICI Prudential Focused Blue Chip Fund

- Birla Sun Life Front Line Equity Fund

- Large and Midcap Funds Invest Online

- ICICI Prudential Dynamic Plan

- HDFC Top 200 Fund

- UTI Dividend Yield Fund

- Mid and SmallCap Funds Invest Online

- Reliance Equity Opportunities Fund

- DSP BlackRock Small & Midcap Fund

- Sundaram Select Midcap

- IDFC Premier Equity Fund

- Small and MicroCap Funds Invest Online

- DSP BlackRock MicroCap Fund

- Sector Funds Invest Online

- Reliance Banking Fund

- Reliance Banking Fund

- Tax Saver MutualFunds Invest Online

- ICICI Prudential Tax Plan

- HDFC Taxsaver

- DSP BlackRock Tax Saver Fund

- Reliance Tax Saver (ELSS) Fund

- Gold Mutual Funds Invest Online

- Relaince Gold Savings Fund

- ICICI Prudential Regular Gold Savings Fund

- HDFC Gold Fund

0 comments:

Post a Comment