Invest In Tax Saving Mutual Funds Online

Equity oriented Hybrid funds – Balanced funds

As explained above the asset allocation in balanced funds comes up as 65-100% in equity and 0-35% in debt. The major advantage of these funds is that these are less volatile as compared to pure equity funds but enjoys the same tax treatment as of equity funds. Long term capital gain tax in balanced fund is NIL and short term capital gain tax is 15% of the gain.

These funds are best suited for a single goal and when investor wants equity like returns but with less risk. But do keep in mind that in balanced funds fund manager has option to increase the equity allocation to maximum of 100% so in those cases you may see increase in volatility of returns.

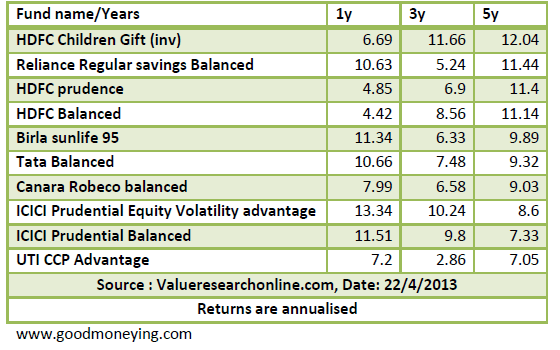

Best balanced funds

as per last 5 years performance are as below:

As I always say that if you are comparing funds only on the returns parameters, do look at annualized and annual return both. Below are the annual returns of the balanced funds selected above:

Debt Oriented hybrid funds:

This is another category of hybrid funds with Asset allocation tilted towards debt side. As the taxation of the all funds having equity allocation below 65% is same, so you will find different variants and combination of debt oriented hybrid funds. Some are categorised as aggressive as they are high on equity allocation compared to others and some are categorized as conservative as they are high on debt allocation. Among these segments some funds are targeted at a particular goal like Monthly income Plans (MIPs) Lets see how the aggressive and conservative segments have performed in last few years.

Best Hybrid funds – Aggressive Asset Allocation

as per last 5 years performance are as below:

Best Hybrid Funds – Conservative Asset Allocation

as per last 5 years performance are as below

You can very well see from the above tables that some of the funds which are under conservative allocation have performed better than hybrid funds with aggressive allocation. And in fact if you compare annualised returns with the balanced funds also, you will not find much difference in last 5 years returns patch. But does that mean conservative funds are better than aggressive ones. No. It's all about asset allocation. Sometime one asset class performs and sometimes other. And this is how your investments should be allocated.

Now days you will also find some fancy names of Hybrid funds like "Capital protection oriented schemes" or "Dual advantage schemes" etc. In reality all these are just close ended versions of normal hybrid schemes.

Should you invest in Hybrid funds?

Hybrid funds can be a good starting point for a new investor. One can select among the balanced funds or debt oriented hybrid funds as per the understanding and risk appetite. Returns should not be the only criteria, better to understand the structure of product and if that structure suits your requirement or not. When one is targeted towards a single goal with a time horizon of 2 or more years and does not want to indulge in designing own asset allocation and rebalance it time and again, these hybrid funds in the form of balanced funds or others can be a good option. Do understand that higher the equity exposure in a portfolio, higher would be the volatility.

Happy Investing!!

We can help. Call 0 94 8300 8300 (India)

Leave your comment with mail ID and we will answer them

OR

You can write back to us at PrajnaCapital [at] Gmail [dot] Com

---------------------------------------------

Invest in Tax Saving Mutual Funds ( ELSS Mutual Funds ) to upto Rs 1 lakh and Save tax under Section 80C.

Invest Tax Saving Mutual Funds Online

Tax Saving Mutual Funds Online

These links can be used to Purchase Mutual Funds Online that are regular also (Investment, non-tax saving)

Download Tax Saving Mutual Fund Application Forms from all AMCs

Download Tax Saving Mutual Fund Applications

These Application Forms can be used for buying regular mutual funds also

Some of the best Tax Saving Mutual Funds available ( ELSS Mutual Funds )

- ICICI Prudential Tax Plan Invest Online

- HDFC TaxSaver Invest Online

- DSP BlackRock Tax Saver Fund Invest Online

- Reliance Tax Saver (ELSS) Fund Invest Online

- Birla Sun Life Tax Relief '96 Invest Online

- IDFC Tax Advantage (ELSS) Fund Invest Online

- SBI Magnum Tax Gain Scheme 1993 Invest Online

- Sundaram Tax Saver Invest Online

- Edelweiss ELSS Invest Online

Best Performing Mutual Funds

- Largecap Funds Invest Online

- DSP BlackRock Top 100 Fund

- ICICI Prudential Focused Blue Chip Fund

- Birla Sun Life Front Line Equity Fund

- Large and Midcap Funds Invest Online

- ICICI Prudential Dynamic Plan

- HDFC Top 200 Fund

- UTI Dividend Yield Fund

- Mid and SmallCap Funds Invest Online

- Reliance Equity Opportunities Fund

- DSP BlackRock Small & Midcap Fund

- Sundaram Select Midcap

- IDFC Premier Equity Fund

- Small and MicroCap Funds Invest Online

- DSP BlackRock MicroCap Fund

- Sector Funds Invest Online

- Reliance Banking Fund

- Reliance Banking Fund

- Tax Saver MutualFunds Invest Online

- ICICI Prudential Tax Plan

- HDFC Taxsaver

- DSP BlackRock Tax Saver Fund

- Reliance Tax Saver (ELSS) Fund

- Gold Mutual Funds Invest Online

- Relaince Gold Savings Fund

- ICICI Prudential Regular Gold Savings Fund

- HDFC Gold Fund

0 comments:

Post a Comment