Mint the leading financial daily rates Health insurance plans based on a variety of parameters. In this two part series, we will look at the best Health Insurance or Mediclaim plans based on Mint's rating. Mint rates Mediclaim plans on a number of factors:-

- Pricing or premiums

- Co-pay requirements

- No claim bonus

- Waiting period for pre-existing medical conditions

- Waiting period for specific diseases

- Disease wise capping

- Disease wise capping

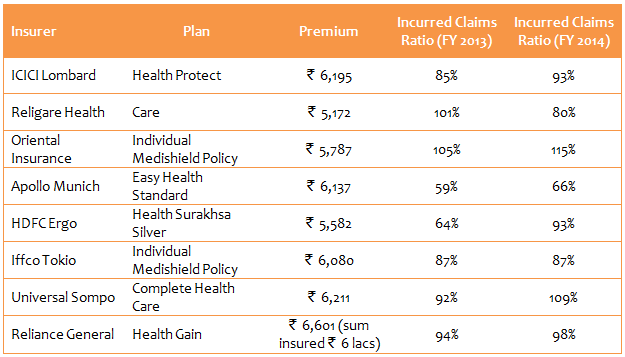

- Claims settlement statistics

In the first part of this series, we will look at the best individual Mediclaim plans based in the most recent Mint ratings. For our selection, we have looked at the overall score assigned to each Mediclaim plan by Mint based on the above factors and selected the plans in the top quartile in terms of overall score. The table below shows the individual Mediclaim plans in the top quartile of Mint's ratings, along with the premiums and the incurred claims ratio. Please note that the premiums are applicable to a 35 year old insured for a sum insured of र 5 lacs, except where mentioned otherwise. Further, please note that the incurred claims ratio is the ratio of the claims incurred by the insurer to the premiums earned by the insurer.

It should be noted that, the premiums of some of the top quartile Mediclaim plans is higher than premiums of some of the lower quartile Mediclaim plans. Premiums should not be the only consideration while buying health insurance. In fact, Mint gives a weightage of only 30% to premiums in their rating methodology. The other factors like Co-pay requirements, No claim bonus, waiting period of pre-existing medical conditions, disease capping and claim settlement track record are also very important considerations in choosing Mediclaim plans.

Conclusion

With the rising cost of healthcare, health insurance or Mediclaim is essential in ensuring our critical healthcare needs. In this article, we have discussed the best individual Mediclaim plans based on the most recent Mint Mediclaim ratings. In the next part of this series, we will discuss the best family floater plans.

(Insurance is the subject matter of the solicitation. For more details on the risk factors, term and conditions please read sales brochure of the respective companies carefully before concluding the sale and/or contact an IRDA Licensed Insurance Advisor/ Insurance Broker)

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

0 comments:

Post a Comment