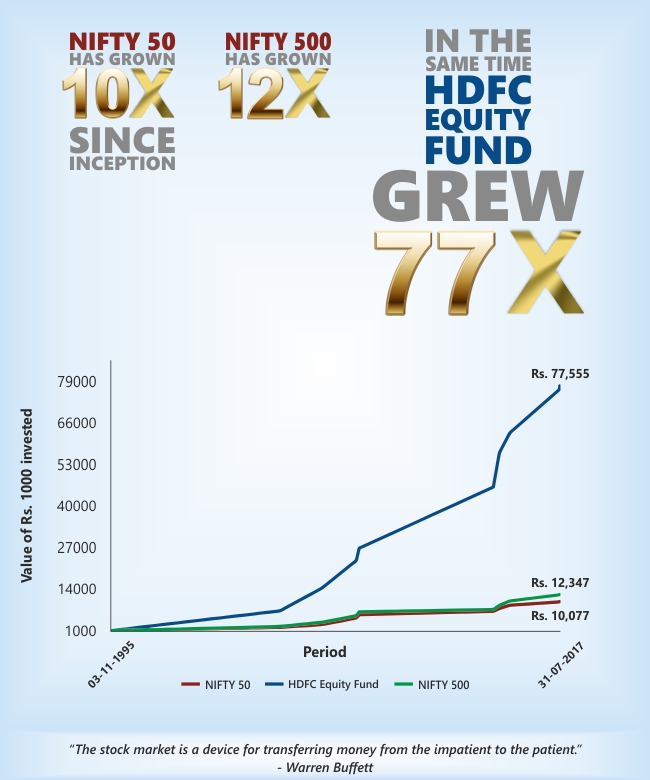

Past performance may or may not be sustained in future. The start date of the period for above simulation taken is November 3, 1995 (base date: NIFTY 50) wherein the base value is 1000 (NIFTY 50), NAV Rs. 7.84 (HDFC Equity Fund – Regular Plan – Growth Option) and 712 (NIFTY 500). The investment amount on the start date for the above calculation assumed is Rs. 1,000. The benchmark of the Scheme is NIFTY 500. The above simulation is for illustrative purposes only. The AMC / Mutual Fund is not guaranteeing or promising or forecasting any returns on investment made in the Scheme.

| ||||||||||||

Period | Scheme Returns (%) | Benchmark % # | Additional Benchmark % ## |

| ||||||||

| Last 1 Year | 25.23 | 19.84 | 16.56 | 12,538 | 11,996 | 11,665 | ||||||

| Last 3 Years | 13.32 | 12.38 | 9.27 | 14,557 | 14,195 | 13,051 | ||||||

| Last 5 Years | 18.96 | 16.33 | 14.01 | 23,832 | 21,310 | 19,272 | ||||||

| Since inception | 19.94 | 10.10 | N.A. | 608,029 | 87,933 | N.A. | ||||||

Past performance may or may not be sustained in the future. Returns greater than 1 year period are compounded annualized (CAGR). Load is not taken into consideration for computation of performance. # NIFTY 500 Index ## NIFTY 50 Index. N.A. Not Available.

Inception date of the Scheme - 1st January, 1995. The Scheme has been managed by Mr. Prashant Jain since 19th June, 2003.

- capital appreciation over long term

- investment predominantly in equity and equity related instruments of medium to large sized companies

Riskometer

Top 10 Tax Saver Mutual Funds for 2017 - 2018

Best 10 ELSS Mutual Funds to Invest in India for 2017

1. DSP BlackRock Tax Saver Fund

2. Tata India Tax Savings Fund

3. Birla Sun Life Tax Relief 96

4. ICICI Prudential Long Term Equity Fund

5. Invesco India Tax Plan

6. Franklin India TaxShield

7. Reliance Tax Saver (ELSS) Fund

8. BNP Paribas Long Term Equity Fund

9. Axis Tax Saver Fund

10. Sundaram Diversified Equity Fund

Invest in Best Performing 2017 Tax Saver Mutual Funds Online

Invest Best Tax Saver Mutual Funds Online

Download Top Tax Saver Mutual Funds Application Forms

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

0 comments:

Post a Comment