Start Best Systematic Transfer Plans Online

Mutual fund investors should be aware of two tools, Systematic Transfer Plans (STPs) and Systematic Withdrawal Plans (SWPs), for their many benefits.

Systematic Withdrawal Plan

How SWP works

* Allows an investor to withdraw a certain sum of money and units from a specified fund at regular intervals.

* Investors avoid market timing when withdrawing money from a scheme, in the same manner as a SIP or STP does when accumulating the money.

How SWP works

* Allows an investor to withdraw a certain sum of money and units from a specified fund at regular intervals.

* Investors avoid market timing when withdrawing money from a scheme, in the same manner as a SIP or STP does when accumulating the money.

Types of SWPs

Fixed withdrawal SWP

A fixed amount that is to be withdrawn from the scheme is defined.

Appreciation withdrawal SWP

Only the appreciated amount on investment is available for withdrawal on the SWP date.

Fixed withdrawal SWP

A fixed amount that is to be withdrawn from the scheme is defined.

Appreciation withdrawal SWP

Only the appreciated amount on investment is available for withdrawal on the SWP date.

How to Start SWP

1. Ascertain if the fund house allows SWP from the scheme. Fill up SWP form. Use separate forms for different schemes, plans and options.

2. Mention frequency of SWP.

3. Mention if SWP is for fixed withdrawal or appreciation withdrawal. Specify amount in case of fixed withdrawal.

4. Mention start and end date. Choose a date on which the SWP transaction should take place.

1. Ascertain if the fund house allows SWP from the scheme. Fill up SWP form. Use separate forms for different schemes, plans and options.

2. Mention frequency of SWP.

3. Mention if SWP is for fixed withdrawal or appreciation withdrawal. Specify amount in case of fixed withdrawal.

4. Mention start and end date. Choose a date on which the SWP transaction should take place.

5. Proceeds from SWP are credited to the bank account registered with the fund house. The SWP will continue for specified duration or till scheme corpus is exhausted.

Bow to Benefit from SWP

* SWP suits individuals who want a regular and fixed cash flow from investments. Retirees can harness this to create a regular annuity instead of depending on irregular dividend payouts.

* If SWP is for a short duration, only initiate from a debt fund for stable withdrawal. SWP from a pure equity fund may subject accumulated corpus to high volatility.

* SWP suits individuals who want a regular and fixed cash flow from investments. Retirees can harness this to create a regular annuity instead of depending on irregular dividend payouts.

* If SWP is for a short duration, only initiate from a debt fund for stable withdrawal. SWP from a pure equity fund may subject accumulated corpus to high volatility.

For longer term SWP, initiate from a hybrid fund to allow healthy growth in corpus.

* Do not opt for appreciation withdrawal SWP from equity fund if you want assured regular income.

* If doing SWP over long term, step up the SWP amount at yearly intervals to account for inflation.

* Do not opt for appreciation withdrawal SWP from equity fund if you want assured regular income.

* If doing SWP over long term, step up the SWP amount at yearly intervals to account for inflation.

SWP works better if you have a sizeable amount to allow a regular withdrawal (the minimum account balance should be Rs 25,000).

Note on SWP

Some fund houses may not allow SWP in a scheme where you have an on going SIP/STP.

Note on SWP

Some fund houses may not allow SWP in a scheme where you have an on going SIP/STP.

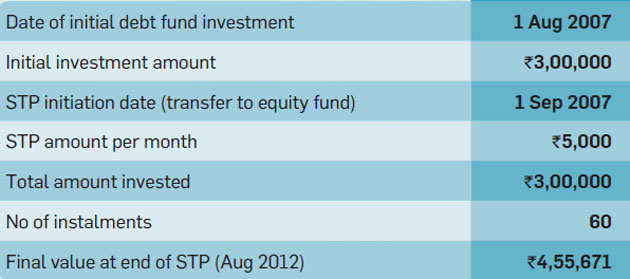

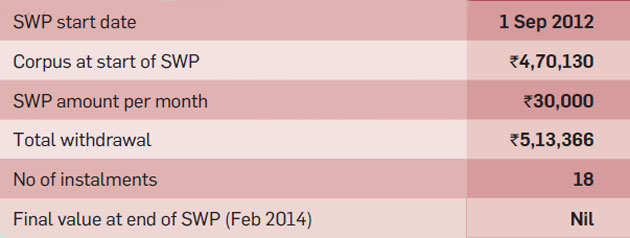

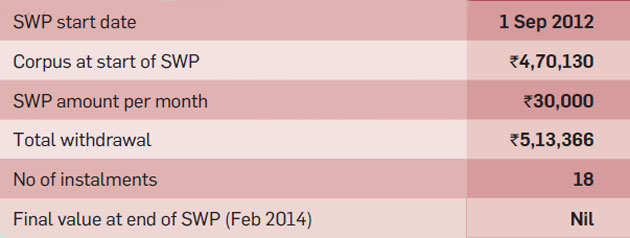

SCENARIO 1 (STP/SWP till corpus is depleted)

Here the investor has accumulated corpus via STP earlier, held on to the funds and later initiated SWP

STP

Here the investor has accumulated corpus via STP earlier, held on to the funds and later initiated SWP

STP

SWP

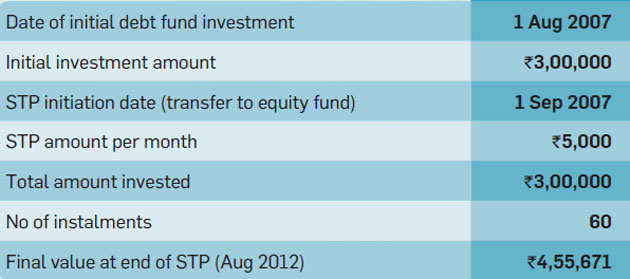

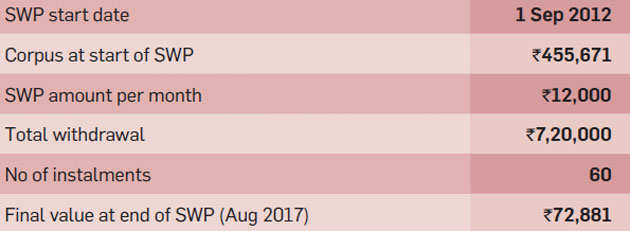

SCENARIO 2 (STP/SWP for specific duration)

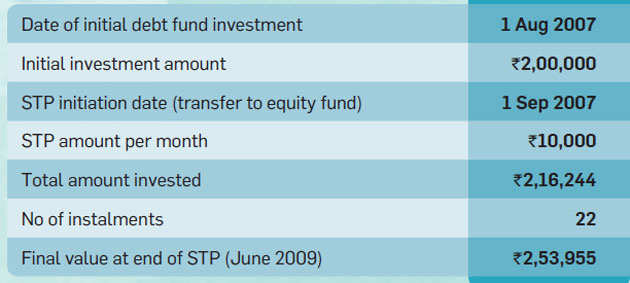

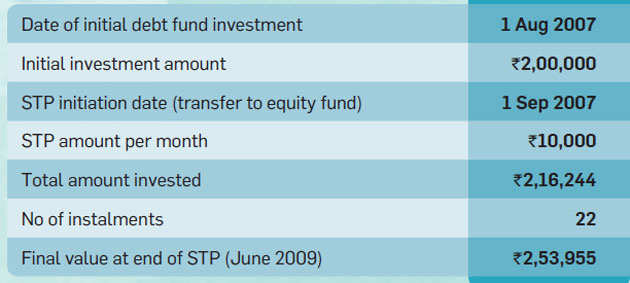

Here the investor has initiated SWP immediately after accumulating the initial corpus using STP.

STP

Here the investor has initiated SWP immediately after accumulating the initial corpus using STP.

STP

SWP

Invest Rs 1,50,000 and Save Tax up to Rs 46,350 under Section 80C. Get Great Returns by Investing in Best Performing ELSS Funds. Save Tax Get Rich

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

0 comments:

Post a Comment