Recently the government made it mandatory to provide both Aadhaar card number and PAN number while filing for taxes.

The 10 character alpha-numeric Permanent Account Number (PAN) is a unique ID that every taxpaying body in India needs to have.

"Mandatory quoting of Aadhaar/Enrolment ID of Aadhaar application form, for filing of return of income and for making an application for allotment of Permanent Account Number with effect from 1st July, 2017," a press statement said.

Here's a guide which can help you to link your Aadhaar and PAN cards.

To link both the identifications, taxpayers first need to register on the Income tax website. Once registered, follow the steps listed below to link the two IDs.

Step 1.

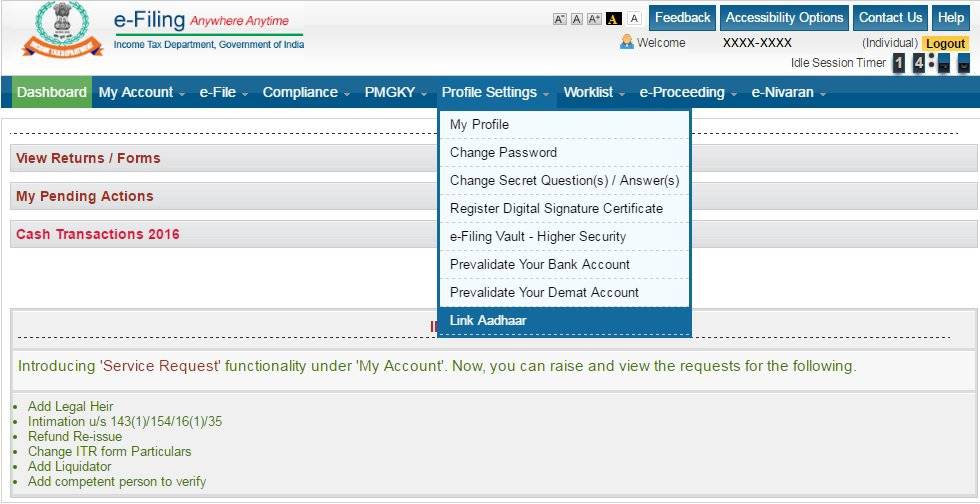

Log in to the e-Filing portal with your user id and password.

STEP 2.

In the various tabs on top of the page, click on profile settings. In the drop down, click on link Aadhaar.

Step 3.

In the new page, you will see your personal details like name, date of birth etc. Verify the details on the screen with your Aadhaar card.

If they match, enter Aadhaar number and click on the 'link now' button.

You will receive a pop-up message saying - "Aadhaar-PAN linking is completed successfully".

Top 10 Tax Saver Mutual Funds for 2017 - 2018

Best 10 ELSS Mutual Funds to invest in India for 2017

1. DSP BlackRock Tax Saver Fund

2. Invesco India Tax Plan

3. Tata India Tax Savings Fund

4. ICICI Prudential Long Term Equity Fund

5. Birla Sun Life Tax Relief 96

6. Franklin India TaxShield

7. Reliance Tax Saver (ELSS) Fund

8. BNP Paribas Long Term Equity Fund

9. Axis Tax Saver Fund

10. Birla Sun Life Tax Plan

Invest in Best Performing 2017 Tax Saver Mutual Funds Online

Invest Best Tax Saver Mutual Funds Online

Download Top Tax Saver Mutual Funds Application Forms

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

0 comments:

Post a Comment