Best SIP Funds Online

In many ways, the first 7-8 years after you are employed and start earning are the most crucial and can decide the course of your entire financial journey. The investor's biggest ally is time and there's no better time to start investing than to do it as early as possible. This is because you can take more risks, have greater flexibility to choose products, and have a better opportunity to save due to fewer liabilities at this stage in life.

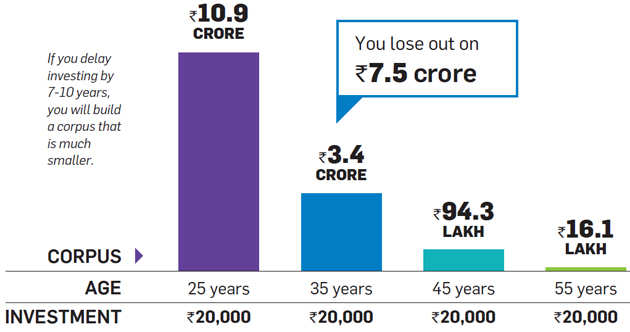

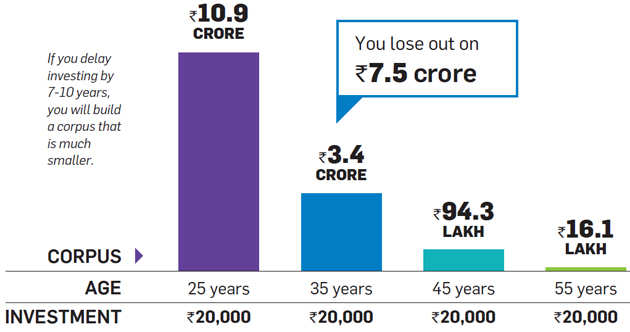

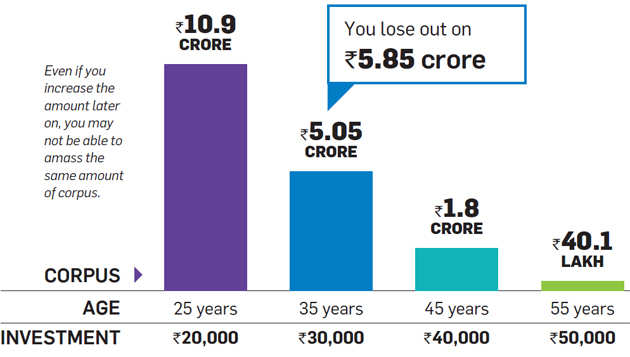

Besides, you can make your money grow through the power of compounding. Compounding means that the interest you earn on your savings keeps earning its own interest. For instance, if a 25-year-old starts saving Rs 2.4 lakh a year, he can build a corpus of Rs 10.9 crore in 35 years at 12% return. However, if he doesn't start investing till he is 35, then to build the same corpus he will have to increase the investment nearly three times or will amass only one-third of the corpus. That is, he will be able to build only Rs 3.4 crore instead of Rs 10.9 crore.

However, compounding can take place only if you are aware of the right instruments and invest wisely. Investors in the age group of 21-29 years typically make the most number of financial mistakes. This means that spending and not saving may be as bad as investing in avenues like traditional insurance policies or Ulips, which lead to wealth erosion.

Since it takes more time to move your investments from the negative to positive rather than vice versa, it is important that you have time on your hands to recoup the losses if you make mistakes in the initial stages.

Benefit from the power of compounding

Assumptions: Current age: 30 years; Retirement age: 60 years; Rate at which savings will grow: 12%.

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

0 comments:

Post a Comment