You paid all your tax dues and filed your return in time; yet you have received a notice under section 143(1) in your mailbox? Don't worry, let's help you understand this notice sent under section 143(1) by the income tax department as well as explain what suitable action can be taken to address it.

Review a few things to make sure this document pertains to your return

- Check your name & address and PAN number

- Check the Assessment Year (AY) for which the notice has been sent. The AY is 2015-16 for return filed for income earned in Financial Year (FY) 2014-15.

- Check your e-filing acknowledgement number

Understanding Notice under section 143(1)

Notice or intimation under section 143(1) is a computer generated record. The income tax department validates each tax return with its own record and this notice usually only points out apparent mistakes found out by the system.

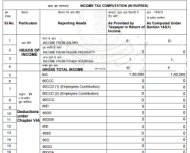

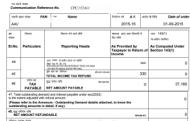

This intimation has two columns 'As provided by taxpayer in the Return of Income' and 'As computed under section 143(1)' where the amounts are compared for these – income under various heads and deductions, TDS and self tax payments. You can run through each of these amounts and find out where the discrepancy is. It could be that a certain TDS has been disallowed or there is a mismatch in self-assessment tax payments, a rounding off error. A final tax due or refundable is computed.

When there is no mismatch

Its likely that all of the fields are matching and there is no tax due or refundable – in such a case you can safely assume the intimation to be an acknowledgement of your tax return. No further action is required from your side.

When there is a final tax due and you agree with it

You need to make payment of this tax due to the income tax department. Read how a payment can be made – here. Once you make a payment of the tax due, no further action is required from your end.

Where there is a final tax due and you do not agree with it

One of the situations where this arises is when a certain TDS has been disallowed. Or a self-assessment tax payment has not been considered. If you do not agree with the final calculations done by the department, you need to file a rectification under section 154(1).

This can be done by – Log on to e-Filing application https://incometaxindiaefiling.gov.in/

and GO TO –> My Account –> Rectification request. You can also reach out to your assessing officer and submit an application in writing.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan

2.Axis Tax Saver Fund

3.IDFC Tax Advantage (ELSS) Fund

4.DSP BlackRock Tax Saver Fund

5.Religare Tax Plan

6.Franklin India TaxShield

7.Canara Robeco Equity Tax Saver

8.BNP Paribas Long Term Equity Fund

9.Reliance Tax Saver (ELSS) Fund

10.HDFC TaxSaver

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online -

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

0 comments:

Post a Comment