We have discussed a number of times on our blog that it is very difficult for the average retail investor to time the markets. Investors sometimes rely on market rumours or simply guesswork to time the market. Such an approach, obviously, does not work most of the time, resulting in sub-optimal returns for the investor. DSP BlackRock Dynamic Asset Allocation Fund employs an analytical approach to dynamically rebalance its portfolio between equity and debt. To determine the asset allocation, i.e. the relative proportions of debt and equity in the portfolio, DSP BlackRock uses a factor known as the yield gap. Yield gap is nothing but the ratio of the debt market yield and the equity market yield. If the yield gap is high it means that the equity market is overpriced relative to the debt market, which is a signal for the portfolio to be more weighted towards debt. On the other hand if the yield gap is low, it means that the equity market is underpriced, which is a signal for increased allocations to equity. DSP BlackRock Dynamic Asset Allocation funds aims to time the market by buying assets at the optimal valuation. The benchmark of the fund is the CRISIL Balanced Fund Index.

How robust is the Dynamic Asset Allocation Fund's yield gap model?

DSP BlackRock has back-tested the model from 2000 and compared the returns with Nifty and the CRISIL Balanced Fund Index. The model has generated better returns than both Nifty and CRISIL Balanced Fund Index across various investment periods. Longer the investment horizon, higher has been the outperformance versus the benchmark. The yield gap model has also outperformed P/E based asset allocation model. The model increases equity allocation from 2001 to 2006 and then reduces it to the lowest level by January 2008. This was the time when the market was at its peak. The model again increases its equity allocation through the bear market of 2008. This shows that the model worked correctly in terms of timing the market.

Fund Overview

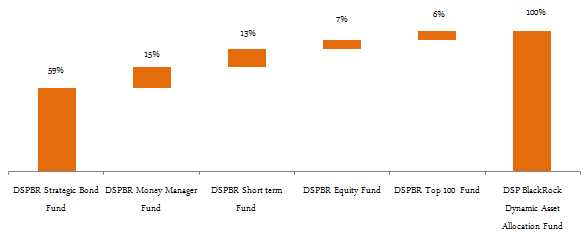

The DSP BlackRock Dynamic Asset Allocation Fund is actually a fund of funds. This fund was launched in February 2014. It has an AUM base of र 1,200 crores. The expense ratio of this fund is 2.17%. As discussed earlier, the fund dynamically rebalances its allocation to debt and equity using the yield gap model. Currently the allocation to debt investment is about 87%, while the allocation to equity is about 13%. The fund can invest between 10 to 90% in equity and similarly between 10 – 90% in debt. Since the DSP BlackRock Dynamic Asset Allocation Fund is a fund of funds, it does not directly invest in securities but in equity and debt mutual fund schemes of DSP BlackRock. Currently the fund has invested in DSP BlackRock Strategic Bond Fund, DSP Black Rock Money Manager Fund and DSP BlackRock Short Term Fund for the debt portion. For the equity portion the fund has invested in DSP BlackRock Equity Fund and DSP BlackRock Top 100 Fund. The chart below shows the portfolio holdings of the DSP BlackRock Dynamic Asset Allocation Fund.

However, investors should note that in future the fund can invest in other DSP BlackRock equity and debt mutual fund schemes.

Yield Gap Model Demystified

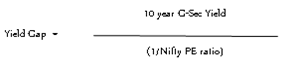

As discussed earlier, yield gap is the ratio of the debt market yield and equity market yield. The parameter used for debt market yield is the 10 year Government Bond (10 year G-sec) yield. The parameter used for equity market yield is earnings of CNX Nifty. The earnings yield is nothing but the reciprocal of the price earnings ratio (PE ratio) that we are familiar with.

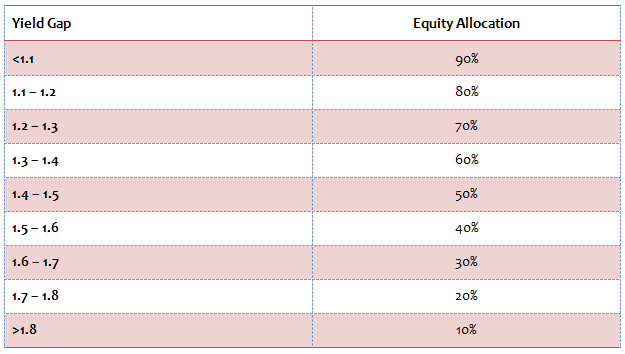

If the yield gap is in the range of 1.4 – 1.5 the asset allocation is 50% debt and 50% equity. If yield gap is lower the allocation to equity his higher and vice versa. DSP BlackRock uses the following allocation bands for the debt and equity allocation of DSP BlackRock Dynamic Asset Allocation Fund.

In addition to the yield gap factor to determine asset allocation, DSP BlackRock also uses a modification of the yield gap. The modified yield gap is the ratio of 1 year G-sec to Nifty earnings yield.

What role does the performance of underlying schemes play?

Some financial advisors argue that while the model of the dynamic asset allocation fund is good, what if the underlying schemes are underperforming? Research has shown that asset allocation is the most important driver of a portfolio's relative performance. While the performance of underlying schemes also plays a role, in comparison to asset allocation, the role is smaller in terms of the portfolio's total returns. Having said that, DSP BlackRock has a fine pedigree as an asset management company and its schemes have been strong performers in the past. In the last one year, the DSP BlackRock has given a trailing return of 12.5%. While the return seems to be on the lower side, relative to other debt oriented hybrid funds, the lower returns can be attributed to higher allocation to debt. Why is the allocation to debt high? The bond yields are still fairly high and earnings are still low, relative to share prices.

Future outlook

The macros of the Indian economy look strong. The IMF and World Bank have revised our GDP growth forecast upwards. As RBI moves towards a lower interest rate regime over the next 12 months, bond yields will decline. Earnings are expected to pick up over the next couple of quarters, as demand and capex cycle revive. The yield gap model will have higher allocation to equity at the right valuations. Consequently one can expect higher returns in the future.

Conclusion

The DSP BlackRock Dynamic Asset Allocation Fund has a lot of merits in terms of the investment methodology. This fund is suitable for investors with moderate to high risk tolerance. However, investors should have a long time horizon when investing in this fund. Investors should consult with their financial advisors if the DSP BlackRock Dynamic Asset Allocation Fund is a suitable investment option for them.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

0 comments:

Post a Comment