Today EPFO launched one more initiative of employees friendly. This is upfront online allotment, registration, or activation of EPF UAN.

What is UAN?

Universal Account Number or UAN account is a unique number allotted to each employee, under which you have multiple EPF number IDs allotted by your employer will be tracked. Suppose if you join a new company then you just need to submit a UAN number to your employer.

It is like a PAN number. Whenever you change the job, just need to quote this UAN to new employer. Your old EPF account will continue under one umbrella of UAN.

What is online activation or registration of EPF UAN?

This is a unique feature started from today. The features of this are explained below.

- Any Indian citizen can now apply for EPF UAN online and activate it. You can apply for EPF UAN even if not a member of EPF. This shows the eagerness of EPFO for spreading the concept of EPF UAN.

- You have to fill an online one-page form.

- There is no need to submit any physical forms.

- You have to complete few online KYC steps. No process is offline.

- You will receive the UAN number to your registered number.

How to activate or register the EPF UAN online?

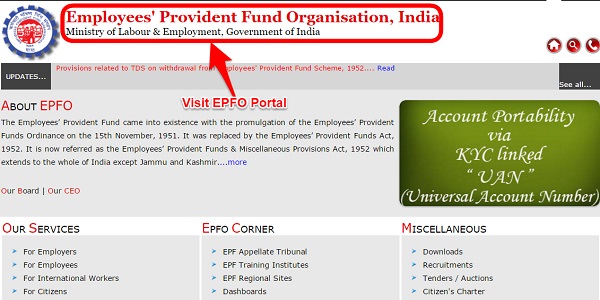

1) Visit EPFO Portal

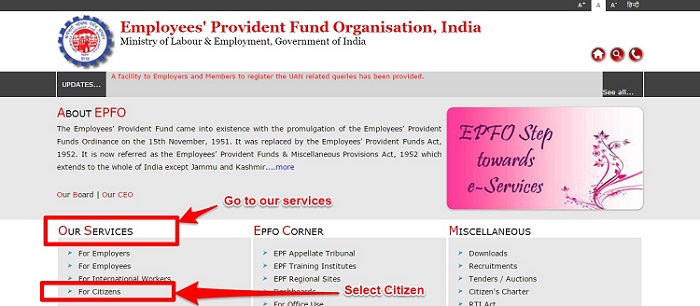

2) Go to "Our Services" and select "For Citizens". They created this section newly.

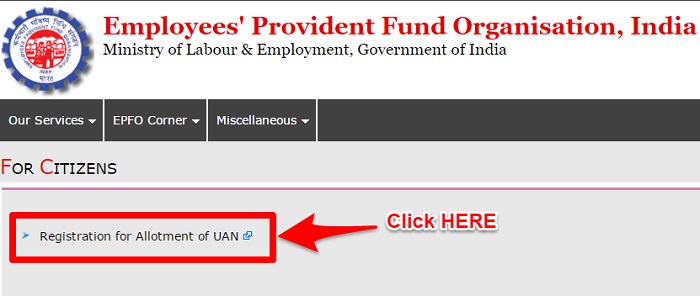

3) This will show you a new pop-up window, click on the "Registration for Allotment of UAN.

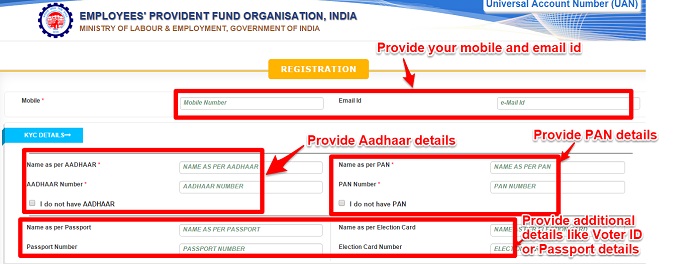

4) This will bring you to the one-page online form. Submit your Aadhaar details and PAN details. If you don't have Aadhaar or PAN card, then you can select "I do not have AADHAAR" or "I do not have PAN". Along with that, you can provide your Passport or Voter ID card details. Remember that providing Passport and Voter ID card details are not mandatory.

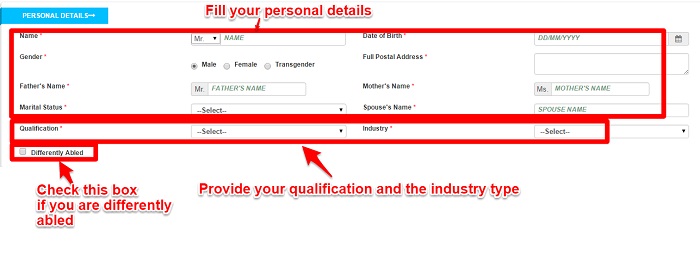

5) Now you have to enter your personal details, qualification and industry type where you are currently working.

6) Next step is to provide your Bank Account number and IFSC code of your Bank. Then upload the photo and scanned signature. Note that your photograph must be taken from digital camera, size must be 3.5 cm x 4.5 cm, image size should be between 15 KB to 20 KB, the image should have dark red background and image should be in JPEG format.

Your scanned image signature should be less than 20 KB and it must be in JPEG format.

![ScreenClip [6]](http://www.basunivesh.com/wp-content/uploads/2015/12/ScreenClip-6.png)

7) Now enter that Captcha code and click on the tab "Get Authorization Pin".

They will send you the PIN to your registered mobile number. This you have to enter it here to authenticate and complete the process.

I hope the process is so simple and it hardly takes any time. Hope this will resolve the problem of activation of EPF UAN.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

0 comments:

Post a Comment