We all know there are term plans available in the market for individuals. But when both husband and wife are earning then why to buy separate term insurance and why not buy a Joint Life Term Insurance? Currently, few insurance companies started to offer such plans. Let us see the details of such plans.

In this plan, both husband and wife will be proposer. Hence, a spouse must undergo the medical test and produce the income proof. Along with these mandatory requirements, both husband and wife must submit all other necessary documents.

Currently in the market, there are so many variants of joint life term insurance policies. However, the two main types are as below.

- Insurance companies pay the death claim amount in the event of any one's death (husband or wife). The policy stops there itself (Also called Single Payout policies). Usually such types of joint life term insurance are cheap.

- Insurance companies pay the death claim amount in the event of any one's death (husband or wife). The surviving spouse will be covered for the sum assured as usual (few may offer premium waiver benefits).

Now let us consider the situations, where spouse bought Rs.1 Cr Joint Life Term Insurance. How the claim be settled in different situations. I considered the basic feature of Joint Life Term Insurance.

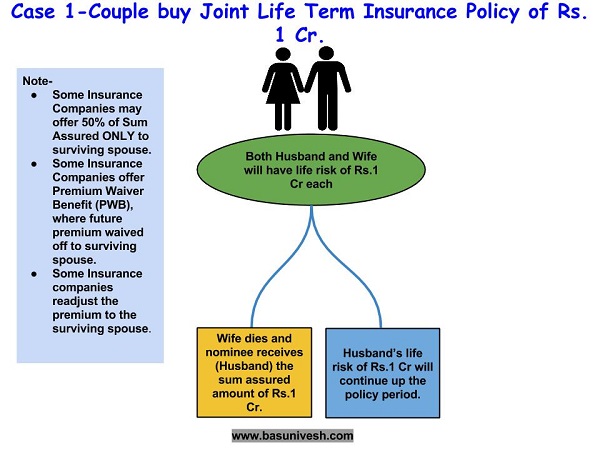

Case 1-

In this case, either a wife or husband dies and the sum insured will be payable to the nominee (husband). The future premium will be waived off. Surviving spouse's life risk will continue as usual up to the remaining policy period. However, as I mentioned in the above note, few companies may offer 50% of the sum assured to the surviving spouse. Another point to note is, few companies have the inbuilt premium waiver benefit, but some may offer it as an additional rider (for which you have to pay the extra premium). Finally, few companies either continue the same premium rate for a surviving spouse or reduce it as the number of insured will come down.

What I explained above is a simple example of the joint life term insurance. However, check with individual insurance companies before going for such joint life term insurance products.

Case 2-

In the above case, death of a spouse occurs together. In such situation, nominee will receive the sum assured amount. Policy terminates there itself.

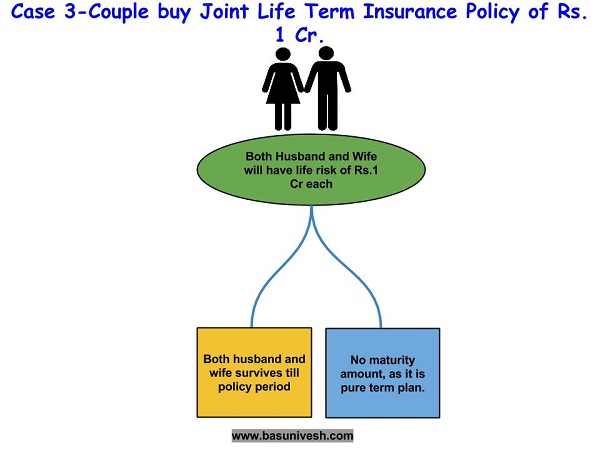

Case 3-

In this case, both husband and wife survive until policy period. As this is pure term plan, both will not get any maturity benefit and policy closes at the maturity date.

Advantages of Joint Life Term Insurance-

- Ease of manage-By holding a single policy, it is easy for a couple to manage their life insurance need.

- Premium Benefit-Instead of buying an individual policy, if you go with a joint life term insurance policy, then the premium will get reduced.

- Some joint life term insurance policies consider the average age of spouse, which may be beneficial in terms of premium rate consideration. However, do remember that some insurance companies may consider the age of the spouse who is older (like family floater health insurance policies).

Disadvantages of Joint Life Term Insurance–

- In the name of joint Life Insurance, your agent may sell you joint life ENDOWMENT PLAN. Hence, be cautious while buying.

- In case spouse death occurs together, then nominee receive on the sum assured. However, if spouse buys separate term insurance, then death claim amount will be based on individual policies sum assured.

- In case of single payout policies, the surviving spouse has to continue without any life insurance.

- If wife stayed away from the job due to managing kids, then no insurance required for her. However, buying such joint life insurance may hard to discontinue, in such situation or separate insured.

- In case of divorce, it is hard to delete any one insured and continue the policy. Either you have to continue the policy in joint name or discontinue.

Which companies currently offer such joint life term insurance products?

Currently, few companies offer such policies with a variety of features. Some of them are as below.

- PNB MetLife's Mera Term Plan

- Aegon Religare's iSpouse

- Bajaj Allianz iSecure

Note-As I said above, there is no uniformity of features among all joint life term insurance policies. Hence, check for features carefully before jumping into it.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

0 comments:

Post a Comment