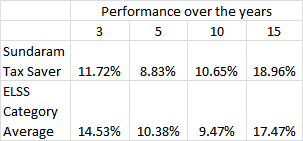

Sundaram Tax Saver has a long history having been around since the end of 1999. And it did get noticed for its performance. In 2007 it delivered 68% in a roaring bull market and its fall the next year was (-)47%, below the category average of -55%. Unfortunately, over the past 7 years, this fund has outperformed the category average just once, in 2012.

Not surprisingly when you take a look at the changes undergone by the fund.

Earlier the fund was managed by N Prasad and Anoop Bhaskar. However, the changes at the helm are stark over the past few years. Satish Ramanathan relinquished portfolio management responsibilities in January 2012 to be replaced by Srividya Rajesh and J. Venkatesan. Rajesh quit the fund house in April 2013 and Venkatesh continued to manage the fund until March 2015. Current fund manager Krishnakumar took over the fund's reins in April 2015.

While Krishnakumar has a lot of experience backing him and has done a good job with Sundaram Select Midcap), senior fund analyst Kavitha Krishnan would like to watch his performance for a while before she concedes to an upgrade.

The changes at the fund management level were also reflected in the fund's investment strategy. Previously run with a large-cap bias (65-70% in large-cap stocks), it then tilted towards a mid-cap bent as exposure to smaller fare went up from 30%-35% to about 40%-50%.

Earlier, the fund was relatively diversified at a sector level with sector weightings being loosely tied to the index (with a permissible deviation of +/-8%). The fund is now run with a more concentrated approach towards sectors with little heed to the index.

As of now, our analyst has adopted a wait-and-watch approach until such time that she gains confidence in the fund.

The latest portfolio seems well diversified at almost 60 stocks with the top 10 holdings cornering 33.65% of the portfolio. The topmost holding - HDFC Bank is at 5%.

- Fund Manager: S. Krishnakumar

- Fund Category: Equity Linked Savings Scheme (equity tax planning)

- Portfolio: A multi-cap strategy that can tend to have a higher exposure to mid-caps compared with its peers.

- Investment Process: A well-defined process; aimed at constructing a growth-oriented portfolio of high-conviction ideas.

Top 4 Tax Saver Mutual Funds for 2016 - 2017

Best 4 ELSS Mutual Funds to invest in India for 2016 - 2017

1. DSP BlackRock Tax Saver Fund

2. Invesco India Tax Plan

3. Tata India Tax Savings Fund

4. BNP Paribas Long Term Equity Fund

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

Invest Best Tax Saver Mutual Funds Online

Download Top Tax Saver Mutual Funds Application Forms

For further information contact Prajna Capital on 94 8300 8300

------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Call us on 94 8300 8300

------------------------------

0 comments:

Post a Comment