Though the multi-decade old fund did maintain a large-cap focus, SEBI's new nomenclature demands that large-cap stocks be defined as the top 100 companies by market capitalisation. Thus the categorisation of the scheme as a large-cap fund, also led to rebranding the scheme to HDFC Top 100 Fund, for it to give a proper picture of the underlying investment objective.

HDFC Top 100 Fund is among the few schemes that boast of a track record of over two decades. The scheme has survived the odds even as the asset managers have come and gone over this period.

The scheme was launch in September 1996 by ITC Threadneedle Asset Management, and was then known as ITC Threadneedle Top 200. Three years later, the Zurich AMC acquired the assets of ITC Threadneedle and rechristened the fund to Zurich India Top 200 Fund in December 1999.

The fund's current fund manager, Mr Prashant Jain who was associated with Zurich since July 1993, took over the reins of Zurich India Top 200 Fund from Mr Bobby Surendranath (the fund manager since inception) in June 2001.

A couple of years later, in June 2003, HDFC MF acquired the assets of Zurich AMC. Zurich India Top 200 Fund was renamed as HDFC Top 200 Fund. Mr Jain continued to manage the assets of the scheme.

For a scheme that has survived thus far, it is unsurprising to see its asset burgeon to nearly Rs 15,000 crore. It was the first equity scheme to breach the Rs 10,000-crore-mark. Unfortunately, the huge influx of assets, and a few fund manager bets that didn't go as planned, led to a deterioration in performance over the past 3-4 years.

Its more flexible peers have delivered a stronger performance and soon began attracting assets away from HDFC Top 100 Fund.

In this brief analysis, we take a close look at the features and performance of HDFC Top 100 Fund, in its previous avatar.

Investment Objective of HDFC Top 100 Fund

HDFC Top 100 Fund has an investment objective to "provide long-term capital appreciation/income by investing predominantly in Large-Cap companies."

The erstwhile investment objective was to "generate long term capital appreciation from a portfolio of equity and equity linked instruments. The investment portfolio will be primarily drawn from the companies in the S&P BSE 200 Index. Further, the Scheme may also invest in listed companies that would qualify to be in the top 200 by market capitalisation on the BSE even though they may not be listed on the BSE"

HDFC Top 100 Fund Fund Details

| Category | Large Cap Fund | Style | Blend |

| Type | Open ended | Market Cap Bias | Large Cap Fund |

| Launch Date | 3-Sep-96 | SI Return (CAGR) | 19.97% |

| Corpus (Cr) | Rs 14,789 | Min./Add. Inv. | Rs 5,000 / Rs 1,000 |

| Expense Ratio (Dir/Reg) | 1.20% / 2.04% | Exit Load | 1% |

SI Return as on June 27, 2018.

- 80% - 100% to stocks of large cap companies as defined by the regulator and prepared by AMFI

- 0% - 20% to other equity and equity related instruments

- 0% - 20% to debt and money market instruments

- 0% - 10% to units of REIT/InvITs

- 0% - 10% to Non-convertible preference shares

- 0% - 100% to Equity, Partly convertible debentures and fully convertible debentures and Bonds

- Balance in debt and money market instruments

Had you invested Rs 10,000 in HDFC Top 100 Fund five years back on June 27, 2013, it would have grown to Rs 21,122 as on June 27, 2018. This translates in to a compounded annualised growth rate of 16.12%. In comparison, a simultaneous investment of Rs 10,000 in its current benchmark – Nifty 100 - TRI index would now be worth Rs 20,933 (a CAGR of 15.91%). As can be seen in the chart alongside, the largecap fund has been struggling to generate a sustainable alpha over the benchmark. It has done well in the market rallies but has been unable to retain its momentum in volatile market periods. Hence, its long term performance against the benchmark does not generate much awe.

HDFC Top 100 Fund Performance (Year-on-Year )

HDFC Top 100 Fund has a track record of over two decades. The year-on-year performance comparison of the fund vis-à-vis its current benchmark – Nifty 100 -TRI Index shows that the fund has outperformed the benchmark in 7 out of last 10 calendar years. Bulk of the alpha was generated in the period over CY2008 to CY2010. The fund outperformed the benchmark by over 5-9 percentage points. Between 2011-13, the fund was found struggling, but managed to deliver returns in line with the benchmark. In CY 2014, with the onset of the current bull rally, HDFC Top 100 Fund, capitalised on the up move with a 11 percentage point gain over the benchmark. But this euphoria was short lived. Over the next few years, HDFC Top 100 Fund delivered a mediocre performance.

In inconsistency in the performance of HDFC Top 100 Fund is clearly visible in the different rolling periods considered above. The large-cap fund has been able to beat the benchmark in the 2-year and 5-year rolling periods, however, in the 1-year and 3-year periods, the fund trails the benchmark. Other peers have managed to deliver a respectable performance over the period considered, despite having a corpus in excess of Rs 10,000 crore.

HDFC Top 100 does not impress on the risk front either. The scheme has a higher volatility than the benchmark and other peers in the category. Due to the high risk and low return potential, the fund fails to entice investors in the form of risk-adjusted returns. Now with a new mandate in place, the fund house needs to decide a corrective course of action.

The top five mutual funds with a similar investment objective and market-cap bias in the 3-year rolling period performance include—SBI BlueChip Fund, Reliance Large Cap Fund, ICICI Prudential Bluechip Fund, and Aditya Birla SL Frontline Equity Fund.

Investment Strategy of HDFC Top 100 Fund

&The investment objective of the HDFC Top 100 Fund is to provide long-term capital appreciation by investing predominantly in Large-Cap companies. The fund will maintain a minimum exposure of 80% to Large Cap stocks. It may also invest upto 20% of AUM in debt and money market securities.

&HDFC Top 100 Fund will remain diversified across key sectors and economic variables. The fund seeks to invest in higher quality, competitive, sustainable businesses by primarily restricting the equity portfolio to large caps; this is intended to reduce risks while maintaining steady growth.

&Focuses on secular growth companies compared to cyclicals; this strategy reduces risk on one hand and improves chances of positive returns over the long term. There are primarily two sources of returns for the fund – Index returns and returns from active management; over periods of time, index returns are expected to form a large portion of total returns. The fund targets to capture a large part of index returns by maintaining around 60% of the portfolio in matched positions with index.

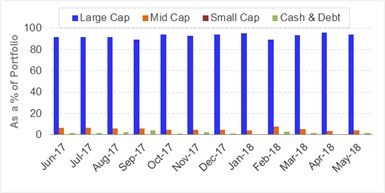

HDFC Top 100 Fund - Portfolio Allocation and Market Capitalisation Trends

Holdings (in %) as on May 31, 2018

Holdings (in %) as on May 31, 2018 (Source: ACEMF)

As can be seen in the chart alongside, HDFC Top 100 Fund has predominantly invested over 90% of its portfolio to large-caps. While the fund has the flexibility to include a decent exposure to midcaps, it has chosen to maintain its exposure to stable bluechip stocks. Over the past year, the large cap exposure has moved in a narrow range of 90%-95%. The exposure to mid caps, which was around 6% a year ago, has fallen to 4%. The allocation to cash has been broadly kept under 2%. However, there have been instances where the cash limits have been raised to 4% to meet certain liquidity or investment requirements.

HDFC Top 100 Fund – Top Portfolio Holdings

|  | ||||||||||||||||||||||

HDFC Bank and Infosys lead the list of stocks in the portfolio of HDFC Top 100 Fund. Both the stocks command an exposure of 7% each. Trailing closely behind are Larsen & Toubro, State Bank of India and ICICI Bank, with an exposure of 6%-7%. Reliance, HDFC and ITC are among the other index heavyweights in the portfolio of HDFC Top 100 Fund.

Though the large-cap fund has as many as 58 stocks in the portfolio, the allocation is concentrated to the top holdings, where the top 10 stocks account for 55% of the assets.

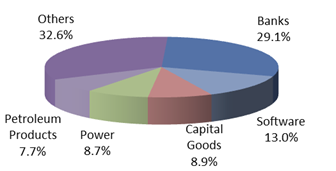

Banks dominate the portfolio with an exposure of 29%. Software stocks are the next top bets with an allocation of 13%. Industrial Capital Goods, Power and Petroleum Products are also among the top five sectors of HDFC Top 100 Fund.

Top Gainers in HDFC Top 100 Fund's portfolio

Out of the 58 stocks in the portfolio, as many as 49 stocks have been held for 12 months or more. About 22 of these stocks generated a return in excess of 10% over the past 1 year. Among the top stocks in the portfolio with the maximum return over the past 1 year were Avenue Supermarts, Reliance Industries, Tata Consultancy Services, HDFC Bank, and Infosys. These stocks rallied 111%, 37%, 37%, 31%, and 26% over the past year.

About 16 stocks in the portfolio declined by 10% or more over the past year. Among the stocks that declined the most over the past year were Rural Electrification Corporation, Power Finance Corporation,

Tata Motors, Union Bank Of India, and Punjab National Bank. These stocks declined 39%, 40%, 41%, 42% and 44% respectively.

Suitability of HDFC Top 100 Fund

Large-cap oriented funds are better poised to handle market volatility vis-à-vis mid-and-small caps. Stable businesses, greater market share, quality of management and the sustainability prospects are factors that seem convincing to take exposure to large-caps at the current level.

Large blue chip companies with strong balance sheets and proven track-records could help ride the wave of short-term volatility to a certain extent. Therefore, diversified equity funds with a predominant large-cap allocation can offer stability to your investment portfolio.

Some large-cap funds take an opportunistic allocation to mid-caps and offer the perfect mix of stability and growth. However, HDFC Top 100 Fund is among those that maintain a pure large-cap exposure.

Given the funds exposure is heavily skewed towards index heavyweights, the returns will be broadly in line with the benchmark. However, the active management of the portfolio can lead to better stock selection and potential outperformance over the index.

The fund maintains a disciplined buy-and-hold investment strategy, which can be suitable for moderate-to-high risk investors.

However, before investing, do weigh all options and make a prudent choice.

SIPs are Best Investments as Stock Market s are move up and down. Volatile is your best friend in making Money and creating enormous Wealth, If you have patience and long term Investing orientation. Invest in Best SIP Mutual Funds and get good returns over a period of time. Know which are the Top SIP Funds to Invest Save Tax Get Rich - Best ELSS Funds

For more information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

0 comments:

Post a Comment