ICICI Prudential Life Insurance launches ICICI Pru Smart Life

ICICI Prudential Life Insurance has launched a new dual protection unit linked insurance plan "ICICI Pru Smart Life". The dual protection comes in a way of lump-sum amount at the death of the policy holder and in addition to this; the nominee will also receive the fund value at the end of the policy term.

Details of ICICI Pru Smart Life Plan:

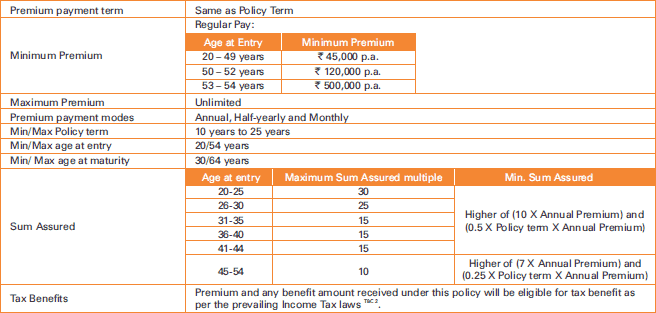

Regular Pay Option

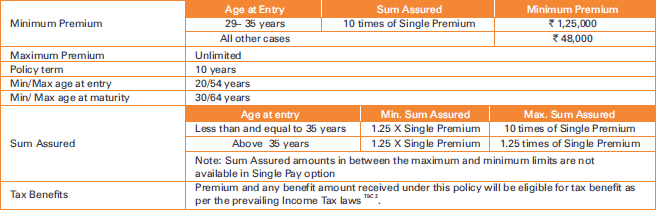

Single/One Pay Option

ICICI Pru Smart Life Plan Benefits:

Death Benefits:

In the unfortunate event of death of the policy holder, the nominee will receive the benefits in two parts:

1. Lump-sum Amount Benefit: On the death of the policy holder, a lump-sum amount is given to the nominee to meet the immediate liabilities. The lump-sum amount will be higher of the followings:

- Sum Assured

- Minimum Death Benefit i.e. 105% of total premiums paid

2. Smart Benefit: Following the death of the policy holder, all future premiums payable under the policy will be waived off and units equivalent to the installment premium will continue to be allocated by the Company on the subsequent premium due dates as if the premiums are being paid along with the loyalty Additions and Wealth Boosters

This Smart benefit is not applicable for the One Pay option.

Survival/Maturity Benefits

If the policy holder survives throughout the policy term, he will receive the fund value at the end of the policy term. The policy holder can opt to withdraw at once or can defer the payout using Settlement Option.

Investing Strategy of the Premiums

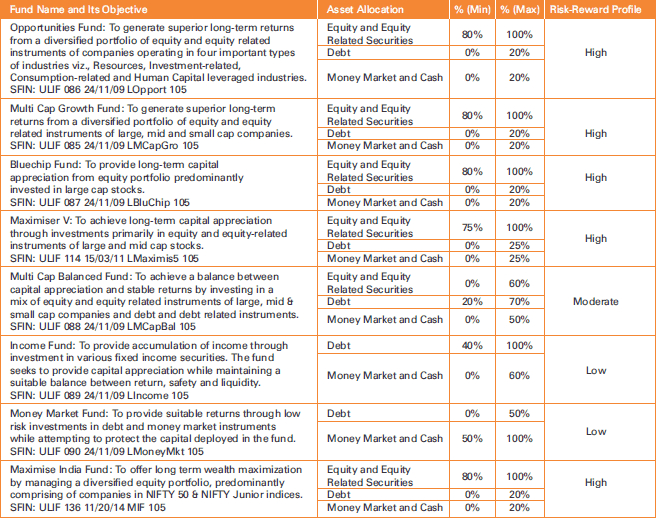

1. Fixed Portfolio Strategy: Funds to be selected from the below given 8 funds and can be switched only once in a year.

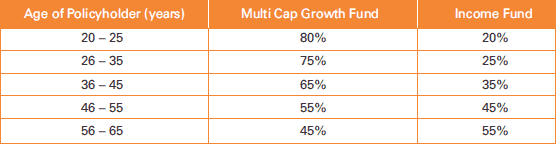

2. LifeCycle based Portfolio Strategy: The premiums will be invested in Multi-Cap Growth Fund as well as in Income Fund, based on the age of the Policy Holder. As he moves from one age band to another, the funds will be re-distributed based on his age.

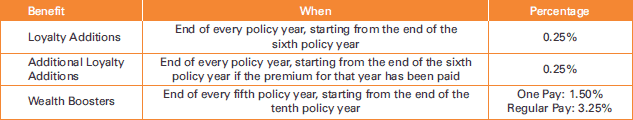

Loyalty Additions and Wealth Boosters

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

0 comments:

Post a Comment