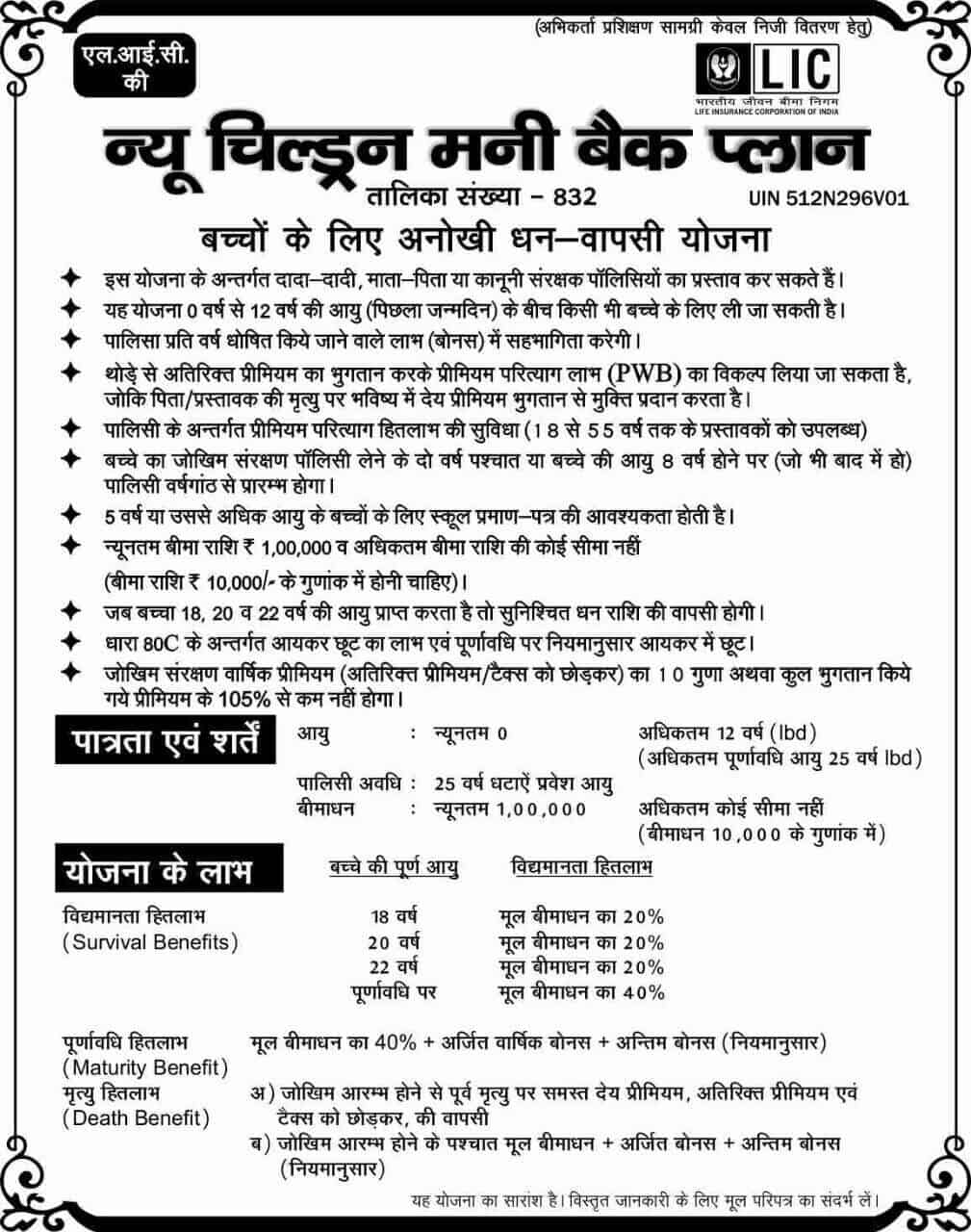

LIC has launched a New Children's Money Back Plan (Table No. 832) which is a non-linked, with profits and regular premium payment money back plan. The plan aims to meet various financial needs like education, marriage etc. of the child through Survival Benefits.

The plan will be open for sale for a maximum period of 90 days from the date of launch i.e. 4thMarch, 2015.

Let's delve into the benefits and other details of LICs New Children's Money Back Plan (No.832)

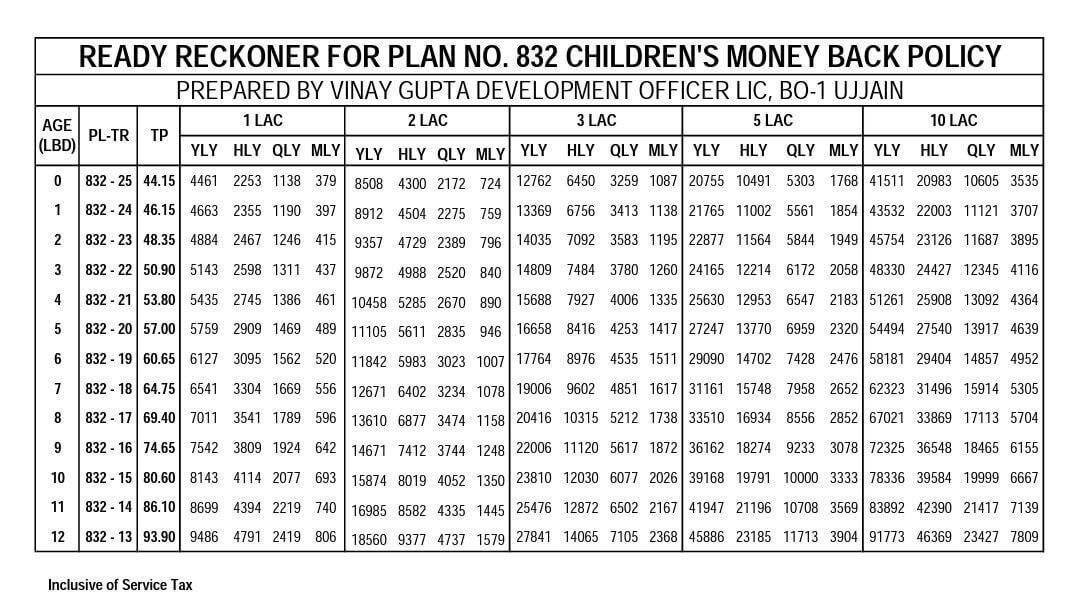

Minimum and Maximum Age for Children (Life Insured): 0 to 12 years

Proposer's age: Minimum – 18 years, Maximum – 55 years

Minimum Sum Assured: Rs.1 Lakh

Maximum Sum Assured: No limit

Sum Assured Rebate:

- Up to Rs.1.90 lakhs = Nil

- Rs.2 lakhs to Rs.4.90 lakhs = Rs 2/- per thousand of Basic Sum Assured

- Rs.5 lakhs & above = Rs 3/- per thousand of Basic Sum Assured

- Modes of Premium Payment: All modes i.e. Yearly, Half-yearly, Quarterly and Monthly.

Mode rebate:

- Yearly Mode – 2% of Tabular Premium

- Half-Yearly Mode- 1% of Tabular Premium

- Quarterly and Monthly Mode- NIL

Policy Term: 25 minus age at entry (Let's say child's age is 5 years then term will be 20 years)

Premium Term: 18 minus age at entry (Let's say child's age is 5 years then term will be 13 years)

Minimum/Maximum Maturity Age: 25 years

Premium Waiver Benefit (PWB) Rider: Yes, Available

Death Benefits:

1. In case the death of the child occurs before the commencement of risk i.e. before the child turns 8, then an amount equal to the total amount of premium paid excluding taxes shall be payable.

2. In case the death of the child occurs after the commencement of risk i.e. after the child turns 8, then the amount shall be equivalent to

Basic Sum Assured + Simple Reversionary Bonus + Final Additional Bonus

In no case, the death benefit shall be less than 105% of the total premiums paid up to the death.

Survival Benefits:

On the Life Assured Survival, the amount payable shall be:

- Completion of age of 18 years of Child : 20% of Basic Sum Assured

- Completion of age of 20 years of Child : 20% of Basic Sum Assured

- Completion of age of 22 years of Child : 20% of Basic Sum Assured

- At Maturity : 40% of Basic Sum Assured + Bonus + Final Additional Bonus

Loan: Loan facility is available after the full payment of premium is made for 3 years and loan should be for the benefit of the Life Assured.

LIC Childern's Money Back Plan (Table 832) – Should I buy?

As per my opinion, this plan will not suffice the purpose of buying it i.e. securing your child's future. With the return of 5% to 6% (maximum of 7%), this plan does not even beat the inflation. Although there is a benefit of insurance coverage but these types of plan are not bought considering the child may die in policy term.

Instead of buying this Children's Money Back Plan, you should invest in other debt instruments like Mutual Funds, Bank Fixed Deposits, Public Provident Fund, Sukanya Samriddhi Account etc. which gives better return of 9%, higher than this plan and also gives a tax-free return with 80C deduction on the contribution.

Details of LICs New Children's Money Back Plan in Hindi

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

0 comments:

Post a Comment