Systematic Investment Plan (SIP) route is one of the best approaches of investing in Mutual Funds for a common man. SIP enables an investor to involve in the stock market but at lesser risk.

What is Systematic Investment Plan (SIP)?

SIP is similar to Recurring Deposits where you have to deposit a predetermined amount (minimum of Rs.500) each month for a stipulated time period in a particular mutual fund scheme.

What is the Sole Benefit of Systematic Investment Plan (SIP)?

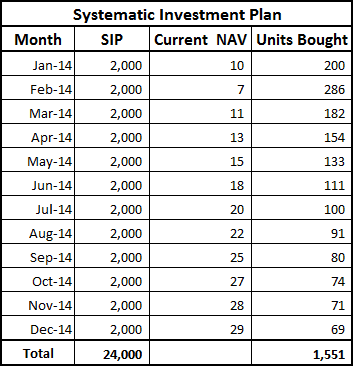

The main advantage of adopting SIP route is to average out the cost of purchase over the time as it enables you to buy mutual funds units at different levels and you can take the advantage of lower prices. Let's understand this with an example.

Average NAV works out to be

(110+7+11+13+15+18+20+22+25+27+28+29)/12) =Rs.18.75/-

Average Purchase Cost of MF Units

(24,000/1551) =Rs.15.48/-

Mr.A invests Rs.2,000 for twelve months through SIP. As we can see the average purchase cost of mutual fund units works out to be Rs.15.48 per unit which is lower than average NAV of Rs.18.75 per unit.

As you have understood the concept of SIP, it's time to see how to maximize returns through SIP route of investment in mutual funds.

How to Maximize your Mutual Fund SIP Returns?

1. Stay Put for Long Term

People tend to invest when market surges and stop when market plunges but this practice defeats the basic purpose of investing through SIP. Staying Invested over the Complete Market Cycle enables you to even out the market volatility and allows you to bank the advantage of lower prices.

By exiting during the market slump, you forgo the advantage of buying additional units of mutual fund because per unit value falls when market crashes. These additional units could give you an edge when market bounce back and may prove the decisive point of holding the concerned mutual fund. So you should hold the mutual fund for at least 3 years till the market cycle complete to benefit from the SIP.

2. Hold Sufficient Number of Mutual Funds in Portfolio

Diversification can be achieved by having 3 to 5 mutual fund schemes in your portfolio. You should not have more than 5 mutual funds unless you have surplus money and want to dip all your fingers into share market. For example if you wish to start SIP of Rs.7,000 per month then instead of putting Rs.1,000 in 7 schemes, you can invest for Rs.1,500 in four and Rs.1,000 in one scheme to maintain the diversification of your portfolio.

Apart from the number of mutual funds, you should also ensure that all your mutual funds are not targeting the same sector means if one of your mutual funds majorly holds shares of banking sector then make sure that other mutual fund schemes in your portfolio are targeting different sectors.

3. Step-Up SIP Approach

Nothing is Constant nor should your SIP. With the rise in your income your savings will go up. So your SIP amount should also increase in the same proportion. The increment is not necessarily be invested into new scheme you can allocate the increased amount into existing mutual funds also.

The step-up SIP approach is useful to adjust the return according to inflation and to keep pace with changing lifestyle. For example, if you invest Rs.5,000 per month and increase this amount by 10% per annum, your corpus would shoot up by 45% from Rs.11.61 lakhs to Rs.16.87 lakhs in a time period of 10 years.

4. Choose Multiple Investment Date for SIP

We all know that Indian Share Market is too volatile and may give jolts at any point of time. Nobody can ascertain the specific time of upward and downward movement of the market. That's why share market trading is not a child's play.

Market volatility indirectly impacts mutual fund performance, thus to mitigate this impact you should fix the SIP at different dates of month. For instance if you have 5 mutual funds in your portfolio, then you could fix different SIP dates for each of the mutual fund like 1st, 8th, 14th, 21stand 28th. So if market goes down on 8th, only one of your mutual fund schemes gets affected.

5. Link SIP to Financial Goals

As an old saying that "A Goal without Plan is just a Wish", so your every investment plan should be backed by the Goal. The goals could be of short-term like going on vacation, buying a car etc. or long-term such as children education, children marriage, retirement etc. Selection of mutual funds must be based on this and every mutual fund SIP should be linked to one financial goal.

You should target Debt Oriented Mutual Funds for your short-term goals because the time horizon is less and safety should be your first concern. Likewise, you should target Equity Oriented Mutual Funds for your long-term goals because the time horizon is not a problem so you could take some risk here.

6. Review Mutual Fund Portfolio every 6 months

Mutual Fund performance is based on various national and international factors. Any Deviation in these factors may affect the performance of scheme. For example last year Rupee value depreciated to Rs.68 per Dollar which made IT services and Pharma Sector most favorable. Likewise, the New Central Government is focusing on ""Housing for all by 2022", this makes infrastructure sector a preferred choice for every mutual fund manager. Ranking and return of the scheme is thoroughly based on the alteration made by mutual fund manager.

Similar to the mutual fund manager you should also review your portfolio twice in a year and switch from the mutual fund scheme whose return and ranking is decreasing constantly. This is the indication of getting out of that mutual fund scheme and invests in new scheme from the same category.

7. Use Systematic Transfer/Withdrawal Plan

Systematic Transfer Plan (STP) means transferring fixed amount from one type of fund to another. STP can be used when you have large chunk of money in your bank. Instead of parking money in Bank, you can transfer money into liquid funds and then get a fixed amount transferred into chosen equity funds via STP. This transfer of money from bank to liquid funds and then liquid funds to equity funds will maximize your returns.

You can also use Systematic Withdrawal Plan (SWP) when you are getting near to your financial goal. That time it is not advisable to stay put in the riskier equity funds. You can start SWP to withdraw a fixed amount by redeeming your mutual fund units.

If you don't want to redeem units you can also go for an STP wherein you can get a fixed amount transferred from equity mutual funds to debt mutual funds which is less riskier and more stable option of protecting your gains and ensure the realization of your financial goal.

Words of Wisdom

Share Market risk in inherent and no one can escape from it. As we all know the concept of "No Risk No Reward" but by following the above tips you can mitigate the risk and maximize returns.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. IDFC Tax Advantage (ELSS) Fund

4. ICICI Prudential Long Term Equity Fund

5. Religare Tax Plan

6. Franklin India TaxShield

7. DSP BlackRock Tax Saver Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

0 comments:

Post a Comment